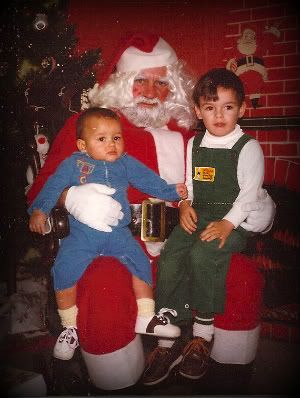

I took a little time off for the holidays to

spend some time with my family. I am glad I got to spend some time with them,

since my brother is in the hospital having gall bladder surgery. I just

heard from my mom he is out and doing well.

I also got a wonderful gift from little face this

Christmas. He is now potty trained. Right before Christmas he was dry for two

days, so after that I said no more diapers and put him in underwear. He now

only wears diapers for sleeping, but most of the time he wakes up dry. Since

this has occurred, I will be reducing my budget down to $50 a week for the new

year. New year = New challenges.

How do you create a realistic budget?

One of the first things you need to do is see where is your money is going right now. Do you purchase most of your items with your debit or credit card or do you use cash? If using debit or credit pull out one or two of your statements. If you use cash this is a little more difficult, since you will need to collect all of your receipts and add them up at the end of the month. Go into excel and create a spreadsheet with row for each category. I will explain this in greater detail below. This way you can see all the buckets your money falls into.

Next look at your house or rent payment. This should not be more than 30% of your take home income. If it is more, you should consider moving or refinancing your home. This is the standard housing allowance for budgets. I worked in the mortgage industry for five years and when analyzing budgets this was our cutoff. If your interest rate is 6% or higher, you should consider refinancing now. Mortgage rates are very low right now. If you don't own, you may consider purchasing a home. By refinancing when the market is low, you may be able to save quite a bit on your mortgage payment. We have refinanced twice and saved $500 off our current payment.

Now take a look at your bills such as electric, water, gas, car payment, insurance and any other bills you may have to pay on a regular basis. Make sure you do an average for things like electric, water and gas, since you are more likely to use more electricity in the summer to cool your home than you use in the winter.

Now review your spreadsheet with all your other

statements to see if you have captured every dollar you spend. Do you have any

annual expenses you pay? Be sure to include that in your monthly budget and set

that money aside every month.

Ok let’s review your spreadsheet. In the first box, put your total household income you actually bring home. Then subtract all of your expenses for the month. How much do you have at the end of the month? If this is nothing or a negative number, you have a problem and need to cut unnecessary items from your budget or reduce one of your boxes. Did you make a payment to your savings account? If you are not saving any money, where are some of the areas you can cut? You should always try to make payment to savings no matter how small. This way if something comes up that you didn't expect, you can pay cash instead of using credit and paying interest which is like throwing your money in the trash.

Next Monday I will talk about areas you can cut

or ways you can save. Have you ever actually sat down and created a budget like

this before? Now is the best time to start, since it is at the beginning of the

year. Wouldn’t be a great habit to save money? Let me know if you have any

questions. I would love to help you save some money this year.

Stay connected with Pounds4Pennies on Facebook or join my Pounds4Pennies on BlogFrog community for more savings.